For a lot of people, Superannuation is very hands off. They sign on with an employer, select the employer default option, their employer makes contributions on their behalf and they forget about it. In fact for some people its so hands off that they don’t even know what their balance is, what their returns are, or have ever looked at a statement. Some people don’t even consider that their super actually belongs to them!

But on the other end of the scale you’ve got people who want to be the masters of their own destiny – they want absolute control of their investments, access to more exotic or non-traditional investments, control of their tax position, their estate planning, and in exchange are prepared to take on a fairly onerous compliance and responsibility burden. These are the growing number of Self Managed Super Fund investors.

But for those who fall somewhere in between, there may be another option that bridges the gap – Investment Wrap (or Super Wrap) platforms.

A wrap platform essentially bundles all of your investments together on one platform, and allows you a access to a huge range of managed funds, ASX listed stocks, International stocks in some cases, AREITS, LIC’s, and ETF’s from which you can design your own investment portfolio – either within super, or outside super. You have access to consolidated performance & tax reporting, and comparisons with major benchmarks so you can keep track of exactly how things are going. To achieve similar reporting across a range of individually held investments you may need to make use of a portfolio management service such as sharesight. Unless you specifically want to invest in direct property, a wrap platform may be the perfect option to increase choice and flexibility without the need to go the whole hog and start an SMSF.

Wrap platforms used to be disgustingly expensive (and some still are), but with increasing competition, prices have become very competitive, and particularly on lower balances are much much cheaper than their SMSF counterparts. All of the major wealth managers have a platform:

- Commbank – Colonial First State (although CBA is spinning off CFS)

- Westpac – Asguard, BT Wrap, or Panorama (although BT has been spun off and is now called Pendall group)

- NAB – MLC

- AMP – MyNorth

- ANZ – well they recently sold their wealth business to IOOF.

Apart from the majors there is also a growing number of smaller platforms aiming to innovate, disrupt and take market share.

- HUB24

- Praemium

- Netwealth

Platform admin fees can be structured as a combination of a flat ‘portfolio fee’, and a admin fee, which is a % of your portfolio balance. There will also typically be discounts as your total portfolio balance increases – however, some of the discounts are structured using a ‘marginal system’ (like your tax – ie: Balances up to $150,000 have a 0.66% fee, amounts over $150,000, but less than $300,000 attract an admin fee of 0.53% so on and so forth), and some platforms have a more simple % fee applied to your entire balance (ie: 0.66% for balances <$150,000, but 0.53% for balances >$150,000 and <$300,00 etc etc). This makes it horribly difficult to compare platforms because it totally depends on your balance.

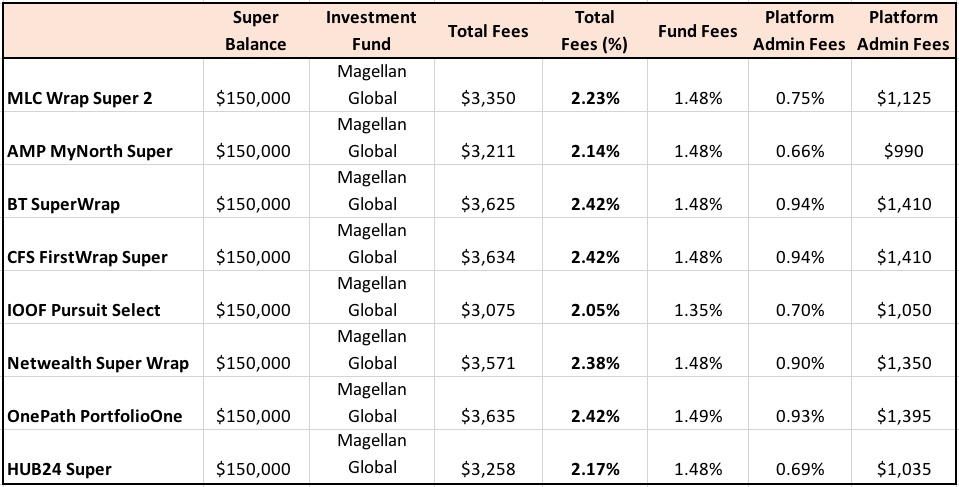

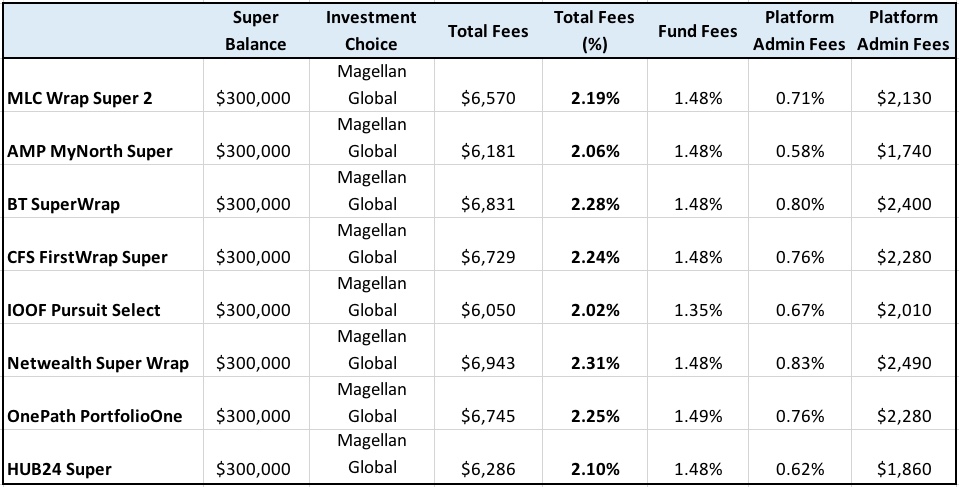

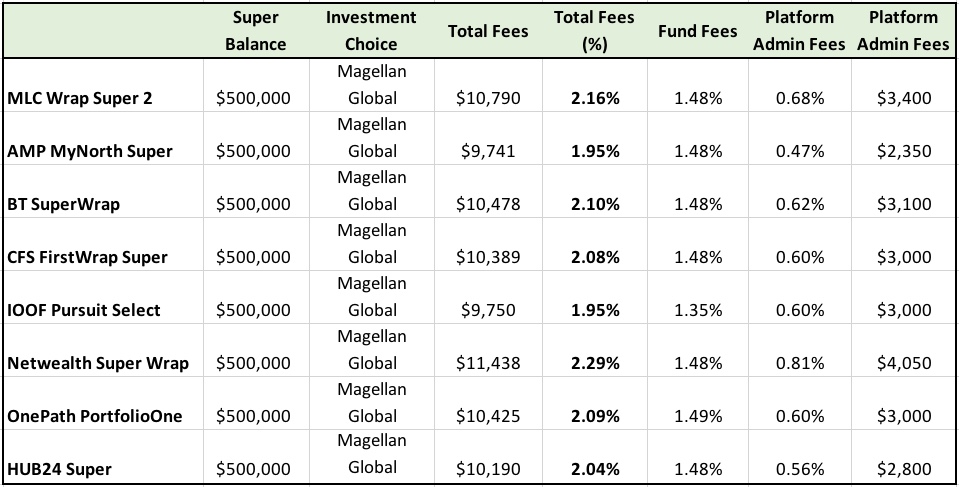

Here is a quick comparison at 3 different portfolio balances so you can see what i mean. I have selected a single fund across all platforms for consistency (although some platforms have negotiated volume based fee discounts with funds – allowing retail investors access to wholesale prices).

*All fees can be found in the relevant PDS for each platform

Some wraps will also have what is referred to as ‘family linking’ where up to 4 family members can use their combined balances to qualify for the tiered discount – in essence each individual would receive the discounted fee structure based on the combined balance of all 4 members, rather than their (even though the portfolios remain very much independent). The same applies for balances of super & outside super wraps. Ie: depending on the platform if you had $200K in super, and an $80K investment portfolio on the same platform, your outside super portfolio would receive the fee structure for a $280K portfolio. In many cases, admin fees are also capped, so they don’t just keep increasing into the thousands of dollars as your portfolio balance increases. For example, on the MyNorth platform, an individual investor will never pay over $3,500 in admin fees, and a linked family of 4 will never pay over $4,500 between them)

So should you use a Wrap or an SMSF?

Well that depends on so many factors, and the full comparison is probably beyond the scope of this article.

- How many funds are available on the platform?

- What investments are available? (Shares, ETF’s, LIC’s, MFunds etc)

- What is the fee structure?

- What is the reporting like?

- How easy is it to transact?

- Can you make in-specie transfers of existing investments into the platform?

- Can you make In-specie transfers out of the platform?

There are so many points to compare and contrast, however if you only ever intended to invest in shares, managed funds, ETF’s, LIC’s and widely held unit trusts (no direct property, art, wine or whiskey) you could probably do a pretty quick comparison solely on a fees basis. Using the 1st table above, on a balance of $150,000 if you can run an SMSF (inc all running costs, reporting, admin, compliance, accounting, and audit obligations) for ~$1,000 then you’re about line-ball with a wrap platform.

Using the second table, on a $300K balance, if you can run an SMSF for <$1,750 then you’re better off in an SMSF (don’t forget to value your time though).

Using the 3rd table, you’re probably better in a wrap platform if your balance is $500,000 and the SMSF alternative costs > ~$2,400. As i said though, there is a multitude of factors and individually important considerations for investors so fees are just one aspect.

I’ve covered off the pros and cons of SMSF’s in Superannuation for the Self Employed – Pt 2 so i won’t reiterate, but here are some pros and cons of a wrap platform:

Features:

- They are operated by a trustee but the investor has a beneficial ownership of the underlying assets (in the case of Investment Wraps – not Super)

- The value of a member’s investment is determined by the underlying assets

- A wrap service uses a cash account for each member that income and expenses are passed through

- All fees and taxes are unbundled from the unit price and disclosed separately

- Any income from the underlying investments is paid into a member’s cash account

- Franking credits are distributed to individual investors through the cash account

- Members’ assets are portable, making it easy for an investor to change wrap services

Pros:

- Access to wholesale funds – You can access a wide range of wholesale funds that you may not be able to access individually.

- Cost – Having all your investments under the one umbrella may reduce your investment costs as the administration service makes buying, selling, and reporting much simpler.

- Online access – You can usually check your investments online at any time.

- Consolidated management and administration – All buying, selling and transacting is managed through a single platform as opposed to trying administer multiple funds individually.

- Comprehensive Reporting – Access to consolidated reporting across all investments held including:

- Asset Allocation

- Overall performance

- Individual asset performance

- Comparison to benchmarks

- Capital gains tax position (realised & unrealised)

- Full transaction statements (all contributions, distributions, fees & rebates)

- Breakdown of multi-manager funds for full transparency of underlying investments

- Portability – With a wrap service you own the underlying investments which gives you the flexibility to move them into or out of the platform.

CONS:

- Cost & Suitability – if your needs are only simple (ownership of only a couple of managed funds for example), you may be paying for features you don’t need.

- Range: Investments are typically limited to the range available on the platform in question (which is typically more than most investors could ever want or need)

- Portability – whilst your underlying investments are all portable, it may not be possible to move all f your investment to another platform, if the same fund isn’t available on both platforms.

So if you’re in an SMSF that doesn’t own direct property, and doesn’t intend to own property, perhaps there is a better way? If you want more control of your super but don’t want to go the whole hog and start and SMSF, perhaps there is another option available?

Remember though, we’ve only touched on a few of the differences and features / benefits, so always consult a financial adviser to assess which option is the most suitable for your unique circumstances.