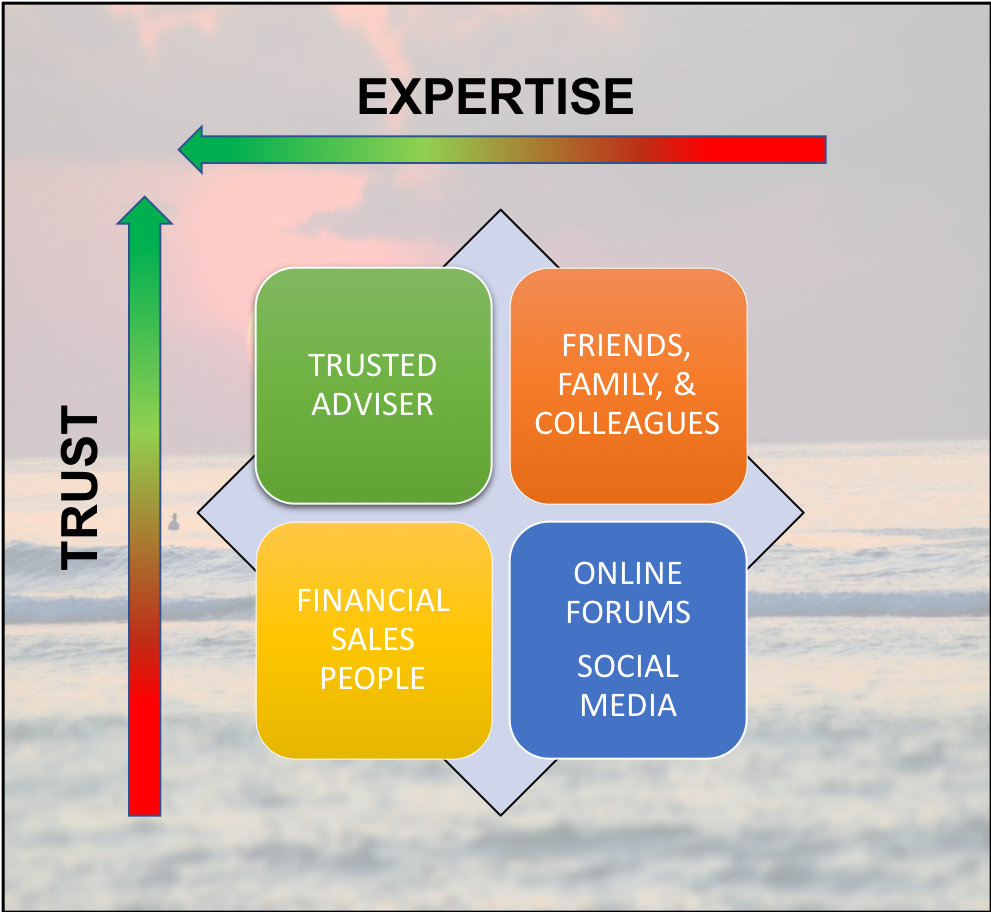

Where you get your financial advice makes an enormous difference to your outcomes. But unfortunately, many people confuse trust for expertise and don’t get the results they had hoped for (or were promised).

Think about it…

Where is your greatest source of trust?

Probably your family & closest friends right? They have your back no matter what, they always have your best interests in mind, and they would never lead you astray…. but are they financial experts?

For most people the answer is probably no – they’re doctors, or lawyers, or teachers, or nurses, or tradies – and if they weren’t family or friends, would you seek financial advice from one of these vocations? I’m sure they love you a great deal, and they may have even had their own financial successes, but are they the right party to be seeking your financial advice from?

Many times advice from family, friends, or colleagues is based on a ‘what worked for me’ approach – not a ‘what is right for you’ approach. “I bought shares in XYZ and I doubled my money, you should buy them”… or “Our investment property in ABC suburb has gone up by 20%, now is a good time to buy”…

Transposing someone else’s financial experiences onto your own (completely different) personal circumstances can be dangerous, so whilst there may be a great deal of trust and faith in these parties, seeking personal financial advice from them is probably not the right thing for you.

What is your greatest source of expertise?

In their search for financial advice, many people will arrange their social contacts in a mental list from most trusted to least trusted – and as they scroll through that mental list they pause at the individual who works in a related field – their perceived subject matter expert. Maybe it’s a mortgage broker, or an accountant, or someone who works in business, or in a bank. They’re in the finance industry right? They should be able to give good advice?

But guess what happens when you ask a mortgage broker for financial advice? surprise surprise…you get a better home loan rate. What happens when you ask an accountant for financial advice? Surprise surprise, you get advice on how to minimise tax.

It’s no different than asking a sparkie for advice about your plumbing, or asking a tiler about painting.

When you approach financial advice with blinkers on, you get very specific outcomes in very specific areas – and often it’s at the expense of your overall big picture goals. You won’t get advice about your cash-flow, and how it relates to your debt strategy, and your investment strategy, and your super strategy, and your personal protection strategy, and your estate planning strategy. You’ll get a better interest rate or a slightly smaller tax bill – Its nice, but it doesn’t solve your problem or set you up for financial success.

For the people who don’t have a related subject matter expert in their social circle, they may succumb to the allure of the financial salespeople. Those standing on the tallest soapbox, shouting their agenda the loudest, and selling their advice the hardest. Property spruikers, insurance salespeople, bank aligned financial planners or mortgage brokers, get-rich-quick social media personalities… this group may have expertise in their chosen field, but are they incentivised in a way that will produce the best outcomes for you?

A famous investor for whom I have a great deal of respect has a saying that I use to help separate salespeople from experts who truly have my best interests at heart…

“Never underestimate the power of incentives” –Charlie Munger

What is the other party getting out of this? How are they remunerated? By whom? Why is all this wonderful advice I’m getting free?

Where is your greatest source of free information?

Some people have a DIY attitude and they turn to the internet for their advice – social media, online forums, news articles, puff pieces etc etc. Some of the worst outcomes I’ve seen are due to ‘advice’ obtained in this way. It’s so hard to separate fact from fiction, to discern motives and incentives, and even if that were possible…. none of the content floating around out there is personalised to you and your unique situation!

It’s entirely possible that the ‘advice’ found in one of these places can be 100% correct and appropriate for one individual, and 100% wrong for another. There is a minefield of bad advice, and ‘fake news’ out there, so approach with a high degree of caution, and a healthy dose of skepticism.

Even if you find advice that seems wonderful, can you trust yourself? Can you consistently discern fact from fiction? Will you make the right choices about what to believe and what to dismiss? Will you turn the right information into a successful action?

The fascinating field of behavioral economics suggests that we human beings make all sorts of flawed & irrational judgments. We often overweight our ability to forecast, to remember, to judge, or to make important decisions based on ‘gut feel’ – even the most rational of us are susceptible, so don’t beat yourself up…we’re human.

So then, where does one find the best combination of trust and expertise when it comes to personal finances?

FIND YOURSELF A TRUSTED ADVISER

You’ve done it with your mechanic, or your hairdresser, or your butcher, or your accountant – now do it in the one area that will make the most profound difference to your financial future.

If you can find an adviser who is both an expert in their field, and who unquestionably has your best interests at heart, then your life will become a breeze. No more wondering, no more guessing, no more stressing about making the wrong choice. You will get clarity, you will get support, and you will be able to make choices based on fact, not hear-say.

Your trusted adviser will work with your other subject matter experts (accountants, solicitors, mortgage brokers etc) to make sure that all of the pieces fit together in a way that serves you best.

Stop looking for your advice in all the wrong places – find yourself a trusted adviser and start enjoying more of life.