So, in part 1 we took a look at the superannuation conundrum for the self employed, and we also took a brief look at what a significant difference time can make to your investment returns (and ultimately your retirement savings).

If you also happened to read Financial Planning Myths you would have also learned that Superannuation is not an investment in and of itself.

“Superannuation is simply a holding structure for investments that comes with some extraordinarily attractive tax benefits, and has a few rules about when you can access the investments within the structure. It is an investment vehicle – not an investment asset in and of it self. Within the tax privileged vehicle that is super, you can control your level of risk by holding investments including cash, term deposits, shares, property, bonds, and alternative investments – in just about any proportion you like! *Hell, you can even own rare artwork, wine and whisky in your superannuation fund!

*inside a SMSF – with some strict rules that ensure these assets are for investing purposes, not impressing your house guests & getting drunk on the good stuff.

I also promised that we’d lift the lid and take a closer look in part II, so let us get our hands dirty, and look at some of the questions posed in part I.

Is my own home a good investment?

This is a funny question, and we really need to qualify it and put it into context. Your own home may be a perfectly good idea for your family and your lifestyle, but a perfectly bad investment.

I can hear torches being lit and a lynch mob forming in the background, so just whoa up a second, let me explain… (in Robert Kiyosaki’s words)

“An asset is something that puts money into your pocket, a liability is something that takes money out of your pocket”

If you were to buy your own home tomorrow for $400,000 with a 20% deposit, at 4.00% interest rates on 30 year P+I terms, you would own it outright in the year 2048 and you would have paid $549,983 (which includes $229,983 of interest). If interest rates were 6.00%, you would have paid $690,683 (of which $370,683 would be interest… $50K more than your entire original loan amount!)

*Assumes monthly repayments, and no extra repayments

Now, everyone needs somewhere to live, so i’m not saying don’t buy a home, but investments are meant to produce income – not just provide shelter. You can’t eat your house, you can’t pay for holidays with it, and you can’t use it to pay for your children’s education. Even if it quadruples in value, to turn it back into cash you need to sell up and move to a cheaper suburb. If you want to stay in it forever, it doesn’t really matter if its worth $1 or $10,000,000 it will serve exactly the same function – provide a roof over you and your families heads.

On the other hand, an ‘Investment Property’ may have cost a similar amount, but your tenant may have paid for ~70%, the tax man chipped in for ~15% (because investment debt is tax deductible), and you only had to come up with the balance of ~15% out of your own pocket. Once you get past the cashflow negative stage, it starts to pay you a regular income, which increases over time with inflation, and once you do own it outright, that income might provide ~$30K – ~$40K in passive income.

*There are exceptions where people may use the equity in their home for a loan for investments – a little bit of have your cake and eat it too, but that is a strategy for a different article.

I am not saying that owning your own home is a bad idea at all – but it is not an investment. Remember the words of Robert Kiyosaki – “An asset is something that puts money into your pocket, a liability is something that takes money out of your pocket”

Government co-contributions to super

Did you know that for low and middle income earners the government will chip in $0.50 for every $1.00 that you contribute to your superannuation as non-concessional contributions (up to $500.00)?

Its not quite “something for nothing”, but all the government is asking in return is that you make a contribution to your own retirement from your own back pocket. There are a few provisos, rules and tests but they are not onerous. Full details can be found on the ATO Website.

Seriously, if you’re earning under $51,813, a government co-contribution could be a marvellous way to help boost your retirement savings.

Tax-deductible super contributions

Did you know that contributions made to your superannuation can be tax deductible? Super contributions are divided into two categories:

1: Concessional (taxed at 15% within your super fund but paid into super BEFORE you are taxed in the outside super world), and 2: Non-concessional (you pay tax on your taxable income according to your MTR, then you make contributions to super from AFTER the tax man has taken his cut).

To illustrate the difference, check out the comparison below:

| Concessional Contributions | Non-Concessional Contributions | |

|---|---|---|

| Gross Income | $60,000 | $60,000 |

| Concessional contributions (taxed at 15%) | $6,000 | $0.00 |

| *Tax | $9,987 | $12,147 |

| Net Income | $44,013 | $47,853 |

| Non-Concessional Contributions | $0.00 | $4,000 |

| Net Income after super contributions | $44,013 | $43,853 |

| Super Contributions After Tax | $5,100 | $4,000 |

*Includes Medicare & Low Income Tax Offset

Recent changes in 2017 mean that anyone (not just self-employed people) can now make tax-deductible (concessional) contributions to super, and as you can see from above, there are some major benefits in terms of your tax savings and your ability to bolster your retirement savings. If you’re unsure of how to make your contributions, your financial planner or your accountant can help you.

Isn’t the stock market risky?

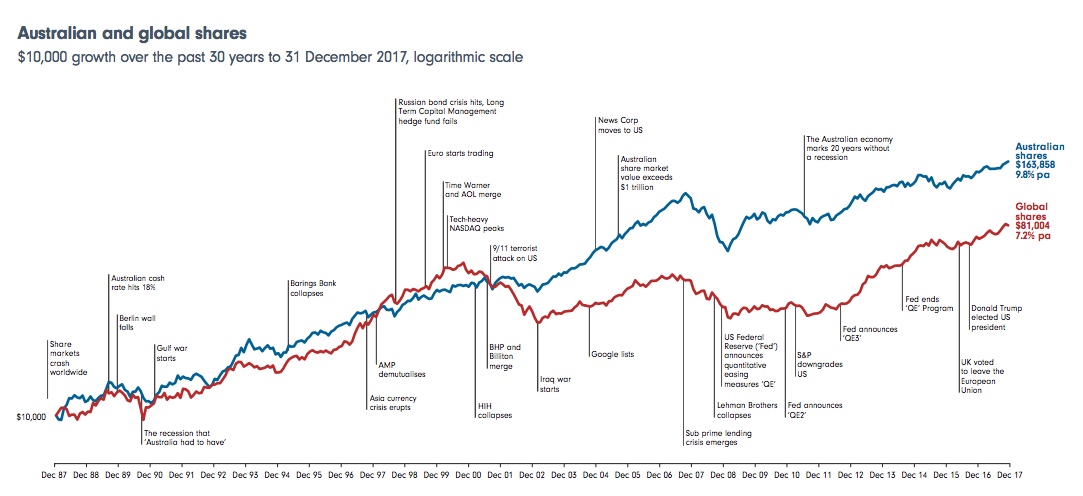

I love this question… but it takes a bit of explaining, and a pretty graph.

For the full chart:

https://www.fidelity.com.au/insights/resources/adviser-resources/sharemarket-chart/a4-handout/

What you are looking at is the growth of a $10,000 investment in either the Australian stockmarket index (Blue), or the Global Stockmarket index (Red) since 1987. If its hard to read, here’s the pertinent bit… the blue line terminates at $163,858! and the red line terminates at $81,004!

So, is the stock market risky if your investment timeframe is:

- A day? – HELL YES (you may as well go to the race track)

- A week? – Absolutely (You thought betting on the horses was risky so you walked down the road to the casino)

- A month? – Dude, you’re still in the casino.

- 5 years? – Well now you’re investing – not gambling, and tour risk of loss is substantially reduced.

- 10 years? – Now we’re talking about a seriously attractive risk / return proposition.

- 30 years? – I’ll just let the chart do the talking.

This fantastic long-term investing report from the ASX gives some marvellous examples of the performance of various asset classes over the long term, and this complex, but incredible chart shows (using various stock markets) that the longer the holding period, the lower the likelihood of loss is.

The point is that time is a incredible and powerful ally when it comes to investing. It helps compound your gains, and it mitigates your chance of loss. A robust investment strategy developed by a financial advisor or a fund manager will always consider the relationship between risk & time. (Most financial products will be advertised with a suggested holding period depending on their level of risk. The suggested holding period for most stock focussed managed funds is 5 – 7 years).

Self Managed Super Funds

If you just can’t stomach the idea of letting someone else be responsible for your financial future, did you know that you can DIY super? That’s right. Self Managed Super Funds allow you the same marvellous tax perks of a more traditional ‘Industry fund’ or ‘Retail fund’, but the investor is the trustee of the fund. A trustee is an individual (or entity) that bears the responsibility for managing the fund on behalf of its members.

Now that you know that Superannuation is a vehicle for holding investments, not an investment in and of itself, that means you can choose the mix of investments you hold within the fund – shares, property, REITS, managed funds, term deposits, cash, bonds, alternative assets, annuities… even art, wine, whiskey and collectibles.

Now while that might sound like a wonderful idea on the surface, be warned….with great power comes great responsibility!

SMSF’s are loaded with traps for young players, and as the trustee of your fund, you need to comply with some very strict rules and regulations – failure to do so can have some extremely heavy penalties. SMSF’s can also be quite expensive to setup and to administer. Here is a brief low down:

A full breakdown of all of the rules & regulations, costs, features, benefits, risks, and considerations is beyond the scope of this article. SMSF’s can be extremely complicated and you should consult a specialist SMSF financial advisor if you would like to explore SMSF’s in more detail. The following list of pros and cons is factual information only and should not be taken as investment advice.

Pros:

- Control. As the trustee of your fund (or a director of the corporate trustee) you are in control of your investments & contributions – but also all of your taxation, legal and compliance obligations.

- Flexibility to hold investments that can’t be accessed through ‘traditional’ super funds (such as direct property)

- Can be cost effective above a certain superannuation balance. For example, a $3,000 annual cost is 0.15% for an SMSF with a member balance of $2,000,000.

- Nimble. It can be quicker and easier for SMSF trustees to move in and out of investments (which may or may not be a good thing).

- Ability to manage tax position. Because you control your investments, you can choose when they are bought and sold, which can have major implications for the tax position of the fund. Assets sold in the pension phase of superannuation will be capital gains tax free.

- Flexibility of Estate Planning. Not being reliant upon an external trustee provides greater flexibility with regards to how (and when) wealth can be passed onto beneficiaries.

- Ability to pool funds. An SMSF with 4 members may be able to pool funds to acquire assets that would be out of reach for each of the members individually (commercial real estate for example).

Cons:

- Significant administrative burden. You know that feeling of dread you get when you have to prepare your tax at the end of the financial year? OK, now multiply that by about 50. An SMSF can have up to four members (which all need to be accounted for separately within the fund), an enormous range of investments covering various asset classes, loans (in certain circumstances), tax deductions and considerations for administrative expenses & running costs, payments for members insurances held within super, ASIC forms & fees for corporate trustees… the list goes on. This can all be very time consuming and needs to be weighed up against the control that it affords you.

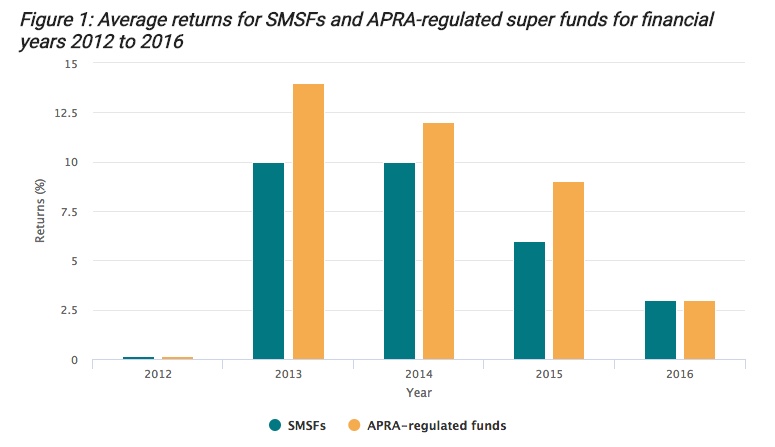

- Risk of Underperformance. The investment returns of members belonging to an Industry or Retail fund are controlled by professional fund managers. Every SMSF trustee needs to consider whether they can do a better job than the pros.

Source: ATO, Self-managed super funds: A statistical overview 2015-16 via ASIC’s Moneysmart

Source: ATO, Self-managed super funds: A statistical overview 2015-16 via ASIC’s Moneysmart - More advanced investment knowledge / skill required. If you are the trustee of your SMSF you are responsible (along with the other trustees – which are also members) for your collective retirement outcomes, and what is probably a significant chunk of your collective ‘life savings’. Without significant investment knowledge and experience there is a risk that these outcomes may not be as favourable as the alternative.

- Strict penalties for breaches of the SIS act and non-compliance. The rules and regulations for SMSFs (super trustees in general actually) are extensive, complicated, and strictly enforced. As a trustee of your fund, it is your responsibility to know all of these rules and ensure that your fund remains compliant. Failure to do so could mean significant tax penalties, and / or administrative penalties. The ATO (responsible for regulating SMSF’s has quite a strong stance that ignorance is not an excuse)

- Risk of being under diversified.

The following table is borrowed from ASIC’s Moneysmart.

In particular, it shows that SMSF’s are overweight cash (which is currently earning extremely low interest rates), Overweight property, and extremely underweight International shares (which makes up ~98% of the stock market)

Table 1: How APRA-regulated super funds and SMSFs are invested, as at 31 December 2017

Investment type | APRA-regulated super funds | Self-managed super funds |

|---|---|---|

| Cash | 11% | 23% |

| Fixed income | 21% | 1% |

| Australian shares | 23% | 30% |

| International shares | 24% | 1% |

| Shares in unlisted companies | 4% | 1% |

| Property | 8% | 15% |

| Infrastructure1 | 5% | N/A |

| Other2 | 4% | 28% |

1 Data on infrastructure investments is not available for SMSFs.

2 ‘Other’ investments for APRA funds include hedge funds. For SMSFs, ‘other’ investments include listed and unlisted trusts, managed investments and collectables.

Source: ATO, Self-managed super fund statistical report – September 2017.

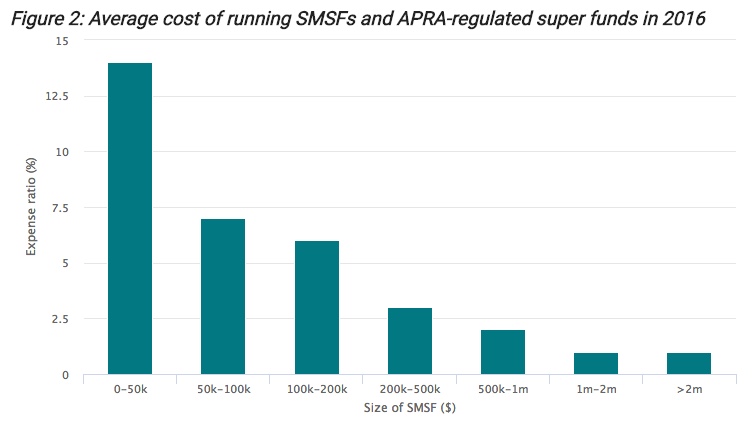

- Can be very expensive for funds with low balances: Using the same example as the pros section, a $3000 SMSF running cost is 3% for a fund with a $100,000 balance. This compares quite unfavourably to APRA regulated funds. The following info is again from ASIC’s Moneysmart.

Consider that if it costs 5% of your fund balance to run your fund, you don’t earn a cent until you’ve made a 5% return. The long term return from shares is ~9% to that means some serious outperformance is required to make up the gap.

Source: ATO, Self-managed super funds: A statistical overview 2015-16.

Well that brings our ‘super for the self-employed’ mini series to a close, but if i’ve managed to inspire some of you to take control of your financial future then i’m a happy blogger. I wish all of you tradies, musos, business owners and entrepreneurs all the very best.

If you have any thoughts, questions or queries you’re more than welcome to get in touch for a chat.

Saul.

*Under some very strict and prohibitive laws that are in place for your protection i cannot give personal financial

advice without doing so through the provision of a Statement of Advice (SOA), which considers your unique personal situation. However, i am more than happy to provide factual information that is not investment advice and does not consider your personal circumstances (and get great joy from doing so).