When i look back on my financial education, i fondly recall the lengths Mum and Dad would go to to instil in me the importance of saving. They would send me off to school every week with a few coins in my Commonwealth Bank Dollarmite deposit wallet (who remembers those?), they would make deals with me where they would match whatever i saved if i wanted something big & expensive, and they would encourage me to set aside a portion of my pocket money rather than spending it all.

Even today Commbank is still running children’s banking education programs. Take a look at the excerpt below from Commbank’s Dollarmites page.

- If you really want to buy something, the quickest way to get it is to save up for it.

- By putting away even small amounts of your pocket money, your savings will soon build up and grow into an amount that will get you what you’re after.

- Whenever you get pocket money, deposit a regular amount straight into your savings account.

- Offer to help around the house to earn extra pocket money.

- Put any spare coins you have in your moneybox and see how quickly it fills up. When it’s full, deposit it into your savings account.

Did you know?

- Every month that you make at least one deposit and don’t take any money out of your Youthsaver account, you’ll earn ‘bonus interest’. Bonus interest is extra money the bank gives you as a reward for saving.

- Try our Savings Tracker to help you keep track of your savings.

*Disclosure: I do not work for Commbank, and have no affiliation whatsoever.

I don’t refute the benefits of this early-stage financial education at all – saving truly is the bedrock of a solid financial education. However, it is only just the beginning, and unfortunately most Australian adults didn’t get part two of their financial education until much later in life – and some cases, not at all. I’m talking about investing.

‘Isn’t saving and investing the same thing?’ you say. Well not exactly – in fact i’d go as far as saying that they’re entirely different things, and serve entirely different purposes in our lives.

To me, ‘saving’ is the financial discipline we employ in order to have sufficient funds for our short term goals, and create excess funds for investment – An absolutely vital part of managing our finances, but certainly not the way to grow wealth over the long-term – that is where ‘Investing’ comes in.

“How many millionaires do you know who have become wealthy by investing in savings accounts? I rest my case.” – Robert G. Allen

So lets take a closer look at saving v’s investing.

| Characteristic | Saving | Investing |

| Timeframe | Short-Medium Term <5-7 Years |

Medium-Long Term >5-7 Years |

| Life Events | – Emergency fund – Buy a new car – House deposit – Life expenses – Holiday |

– Children’s education – Help your children buy their first home. – Create ‘passive income’ – Retire early – Comfortable retirement – ‘Financial freedom’ |

| Risk | – No risk of capital loss – Risk of purchasing power being eroded by inflation. |

– Higher risk – Risks mitigated with time & diversification |

| Reward | – Low returns from saving account interest | – Average long-term returns from Property & Shares is 2.5-3 x the current saving account interest rate |

Whilst they may seem similar on face value, it is really important that we make a distinction between saving and investing because the consequences of matching the wrong one with the life goal in question can be significant. Lets take a look at two life goals and the difference between getting it ‘right’ and getting it ‘wrong’.

Example 1:

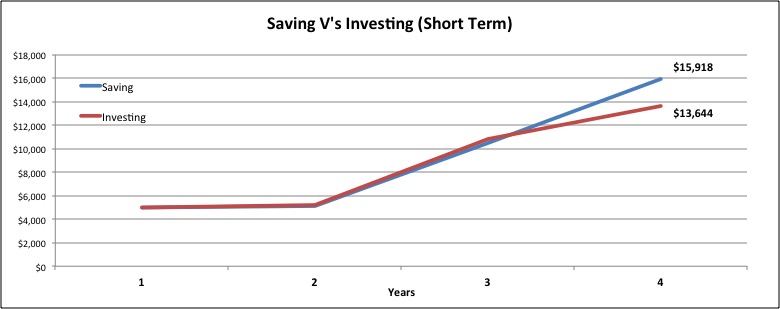

Goal: Buy a new (second hand) car.

Amount required: $16,000

Timeframe: 3 years

Annual savings: $5,000

Bank interest rate: 3%

Investment option: Stock market

Over the short term, stock market returns can vary significantly and can produce negative returns every 4 – 5 years. Should one of those years occur when you need to turn your investment back into cash, you may wind up having to accept a capital loss. In our example above, an unfortunate -14% return in year 3 results in a loss of $2,221 and undoes the positive returns of years 1 & 2. Overall, $1,366 of your hard earned saving has disappeared!

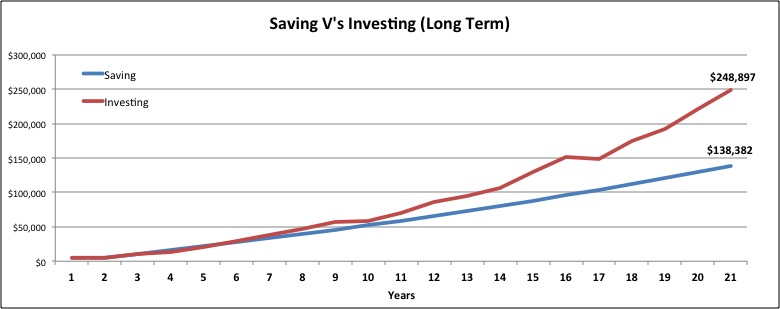

Example 2: (The first 3 years are extended out to a 20 year timeframe)

Goals: Pay for daughters wedding, Put 3 kids through Uni, help each child with house deposit.

Amount required: $200,000

Timeframe: 20 years

Annual contributions to investing: $5,000

Bank interest rate: 3%

Investment option: Stock market

*Investing returns example features 3 years of negative returns, but an average return of

*Investing returns example features 3 years of negative returns, but an average return of

7.16% p.a (below the long term stock market average of 9%)

After you get past your rough start in the first 3 years, you quickly recognise that over the longer term the odd negative year is easily outweighed by the many positive years, and an average annual return of 7.16% is achieved. Due to the effect of compounding, that return has produced $148,897 in profit, vs $38,382 from bank interest – your net position has grown to ~$250K, which covers the kids education, your daughters wedding, 3 house deposit contributions, and leaves $50K for a nice holiday (you’ve earned it!).

So there you have it – by choosing to ‘invest’ for your short term goal of buying a car, you’ve blown a few thousand dollars and come up short on the required funds – not the end of the world, but certainly not very fun either! On the other hand by choosing to ‘save’ for your long-term goals rather than ‘invest’, you’ve robbed yourself of over $100,000 that could have been used for those precious life goals that will really make a difference to you and your family’s life.

Saving v’s investing is very much a ‘horses for courses’ scenario, but as a quick rule of thumb – save for short term goals, and invest for the long term.

A good financial planner will help clarify your short, medium & long-term financial goals, and what you need to do to achieve them – budget, save, invest, or restructure. Whatever the answer may be, you’ll feel better that your financial future is secured with a clear and defined pathway – and the support you need to navigate it!

Happy Investing (and Saving)

Saul.

Great info and topic Saul!! I like your style!