Its no secret that Australians have a love affair with property – for generations ‘The Great Australian Dream’ has been home ownership…but it doesn’t stop there. Our love affair has also spilled over into the way we invest, and for many Australian’s ‘investing’ means buying an investment property. With long term investment returns from real estate neck-and-neck with returns from Australian shares, its easy to see why, but did you know that there are ways to get exposure to this high-growth asset class other than saving up 20% of the buy price, getting yourself in a load of debt and renting it out?

You may be surprised to learn that there are multiple ways to own property, and even more ways to gain exposure to property via other investments, so here are 8 ways to invest in real estate.

1. Direct ownership (residential property)

The good old fashioned way – save up a deposit, go and see your mortgage broker for a loan, get pre-approved, and go shopping for a residential property. Ownership may be as an individual, or jointly with one or more parties. There are a couple of different ownership options for joint purchasers (joint tenants or tenants in common), each with their own quirks and considerations, but we’ll look at those in more detail in the coming weeks. There are also a number of different strategies to consider within this subset of real estate investing:

- Negative Gearing vs Positive Gearing

- Renovating for profit

- Property development

- Boarding houses

This is by far the most well known method of investing in real estate, and for many, their first foray into property investing. Investing in residential real estate can be extremely rewarding, but should be considered part of a balanced investments strategy (not the only strategy).

2. Direct Ownership (Commercial Real estate)

This is much like option number 1 – but with a few key exceptions and considerations.

- Commercial properties are valued slightly differently than residential properties – the valuation is highly dependent on the amount of income (rent) the property can generate.

- Contract terms are typically MUCH longer than residential real estate – most often an initial term, followed by one or more ‘options’ to renew. For example, a 2 x 3 x 3 lease would be a 2 year initial lease with an option to renew for 3 years, and a further option to renew for another 3 years after that.

- Loan-to-value ratios for commercial properties are lower than that of residential real estate – where you might be able to borrow 90 or even 95% for residential loans, you may only be able to borrow 75 or 80% for commercial property.

- Rental yields are typically much higher than residential real estate – this is also boosted by the fact that tenants typically pay all outgoings (rates, water, repairs & maintenance)

- Vacancy rates in commercial real estate are highly correlated to the business cycle, and economic conditions. When business confidence is low, losing a tenant can result in extremely long vacancies.

With its heavy tilt towards income, a commercial property strategy can be great for later in an investor’s journey when income from employment tapers off and needs to be replaced by income from investments (you can’t pay for holidays or groceries with unrealised capital gains!)

3. Direct Ownership (Industrial Real Estate)

Did you know that you can invest in real estate via:

- Storage units / sheds

- Renting out your garages or cark parking space

- Warehouses

- Workshops

- Office spaces.

Beware though, industrial real estate can be significantly riskier than other types of real estate and often requires significantly more capital for purchases.

4. In a SMSF

Did you know you can invest in real estate via a self managed super fund?

A SMSF can borrow and invest in residential or commercial real estate, but be aware – there are many tricks and traps that make investing via an SMSF very very different to investing outside super. There are strict rules about what you can and cannot do (and heavy penalties for SMSF trustees if they’re breached) so you should always consult a specialist SMSF financial advisor before jumping in.

- Loan to value ratios for SMSFs can be significantly lower than equivalent loans for individuals or outside super structures.

- There may be land tax implications

- There are limits on modifications, improvements or alterations that can be done whilst there is outstanding debt.

- No negative gearing benefits that are available to individual investors

5. Buying REITS

Real Estate Investment Trusts are specialist property investment businesses. They own portfolios of real estate assets – from hotels, to warehouses, office blocks, or factories and industrial parks. Investors can buy units in REITS in the same way as managed funds, allowing them to gain exposure to assets that would typically be beyond the reach of individual investors. For ASX listed property trusts, investors can buy or sell units in exactly the same way as they would for direct shares, allowing diversified property exposure with as little as $500. Here are a few Australian REITs you may have heard of:

- Westfield (WFD) – Retail Shopping Centres

- Ale Property Group (LEP) – Owns some of the biggest Hotels in our major capital cities

- BWP Trust (BWP) – The largest owner of Bunnings Warehouse sites

- Lend Lease (LLC) – Barangaroo, Brisbane Showgrounds, Circular Quay Tower, Darling Square Sydney, Melbourne Quarter.

- Ingenia Group (INA) – Manufactured Housing & Tourist Parks

6. Buying Infrastructure stocks or stocks with real estate exposure

Many ASX listed stocks have significant exposure to real estate – Sydney Airport (SYD) and Transurban (TCL) are great examples. You may prefer to combine great companies and real estate exposure in one tidy package by investing in REA group (REA) owner of realestate.com.au, or Domain (DHG), owner of domain.com.au. You will also find McGrath realestate agents (MEA), and Real Estate Investar (REV) on the ASX boards.

7. Buying Diversified Managed Funds

If you have a super fund there is a 90% chance you’re already a real estate investor! Diversified managed funds have exposure to many asset classes (shares, property, bonds & fixed interest, cash, and alternatives), so chances are if you have units in one of these funds, you have exposure to property. If you wish to have more control over how much exposure you have, you can invest in more sophisticated super funds that allow you more control over your investments. Diversified Managed funds can be inside our outside super investments – typically you can identify them because they are named according to their growth / risk profile (conservative, balanced, growth, high growth etc).

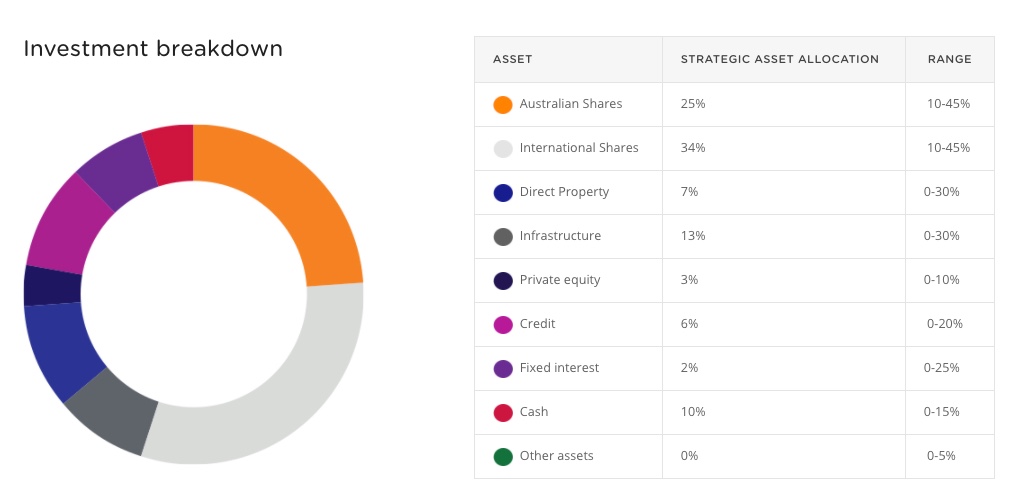

For example if you were in Australian Super’s ‘Balanced’ investment option, here is how your super is invested.

8. Property ETFs

Exchange Traded Funds are passive investments that allow you to gain exposure to an entire index. For example, buying units in the Vanguard Australian Property Securities Index ETF (VAP) is basically the equivalent of buying every AREIT in the ASX300 index in equal proportion to its weight in the index. By using ETFs you can achieve diversification across multiple property sectors with small investment amounts. International ETFs will also gain you exposure to property around the globe (easier and safer than trying to buy a house overseas, thats for sure!)

So there you have it – not an exhaustive list, but 8 ways you can gain exposure to property. There is no one-size fits all solution, and there are no ‘right’ or ‘wrong’ options. There are however safer or riskier options, easier or harder options, and a whole raft of considerations within each of those! If property investing is on your mind and you want to explore your options, get in touch for a chat or drop in and see me at CHG Integrated Wealth and see which strategy is right for you.

All the best

Saul.